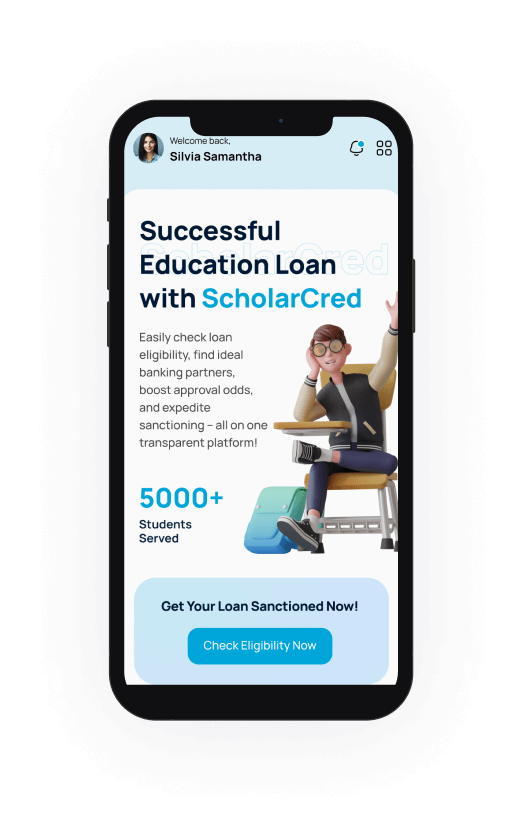

ScholarCred offers a seamless and efficient way to obtain education loans for both domestic and international studies.. With competitive interest rates, flexible repayment options, and a user-friendly application process, ScholarCred is your trusted partner in financing your education.

Dreaming of higher education abroad? ScholarCred is here to make that dream a reality!

Our platform offers comprehensive education loan solutions tailored to meet your financial needs, ensuring you can focus on your studies without worrying about funds. Whether you need a secured loan backed by collateral like property or fixed deposits, which often come with lower interest rates and higher loan amounts, or an unsecured loan that requires no collateral and provides faster, more accessible funding, ScholarCred has got you covered.

With our streamlined application process, quick approvals, and minimal hassle, we aim to make the financial aspect of your educational journey as smooth and stress-free as possible. Trust ScholarCred to support you in achieving your academic aspirations and making your study abroad experience truly unforgettable.

ScholarCred offers pre-approved loans for over 400 universities across the country, providing students with ready access to financial support. Additionally, we currently extend unsecured loans to 500+ colleges, ensuring broader accessibility. Our services cover a wide range of courses, including one-year executive programs, accommodating diverse educational needs. With competitive interest rates, flexible repayment options, and minimal documentation, ScholarCred simplifies the loan application process, empowering students to pursue their academic aspirations effortlessly.

Download the Scholarcred application from your app store. It's available for both iOS and Android devices.

Open the app and start by filling out the preliminary and detailed screening pages. Provide accurate information to help us understand your requirements better.

Once you’ve submitted your details, a dedicated Relationship Manager will identify the best fit banking partner according to your profile. We will make sure to find the most suitable option for you.

Next, upload the required documents through the app. Our system will guide you through the documents needed. Once uploaded, the process is initiated.

Throughout the process, you'll receive regular updates from your Relationship Manager. They will keep you informed at every stage, ensuring a smooth and transparent process.

ScholarCred provides tailored solutions, ensuring you can focus on your studies worry-free. Choose from secured loans with lower rates and higher amounts, or unsecured options for quick, accessible funding. ScholarCred supports your educational journey comprehensively.

When you choose us as your education financing partner, you can rely on us for help with

Customized loans with flexible repayment and competitive interest rates.

Secure international money transfers with competitive exchange rates.

Safe and affordable accommodation solutions for international students.

Financial planning to help save and invest for higher education.

Quick and student-friendly bank account opening services.

Insurance plans covering all aspects of student life and education.

An education loan is a financial assistance program designed to help students cover the costs associated with their education, including tuition, books, and living expenses. It can be used for both domestic and international studies.

Eligibility criteria vary by lender but generally include:

There are two main types:

For a detailed list, refer to our Education Loan Document Checklist page. Generally, documents include: